Coronavirus Help • April 6, 2020

Help for the self-employed

Written by Jennifer Ormond

Whilst it is not within our remit to advise on self-employed people rather than employees, we have been asked about sick pay for self-employed. We can now report that:-

The House of Commons Public Bill Committee has proposed an amendment to the Coronavirus Bill, (Note that this is still only a Bill and has not been enacted yet as law) entitled Statutory Self-Employment Pay. If the Bill becomes law and the proposed amendment is accepted, then regulations will enable “freelancers” (which are not defined) and “self-employed people” will receive guaranteed earnings of:-

(a) 80% of their monthly net earnings, averaged over the last three years; or (b) £2,917 per month whichever is the lower.

FINGERS CROSSED FOR ALL YOU SELF-EMPLOYED WORKERS!

You might also like…

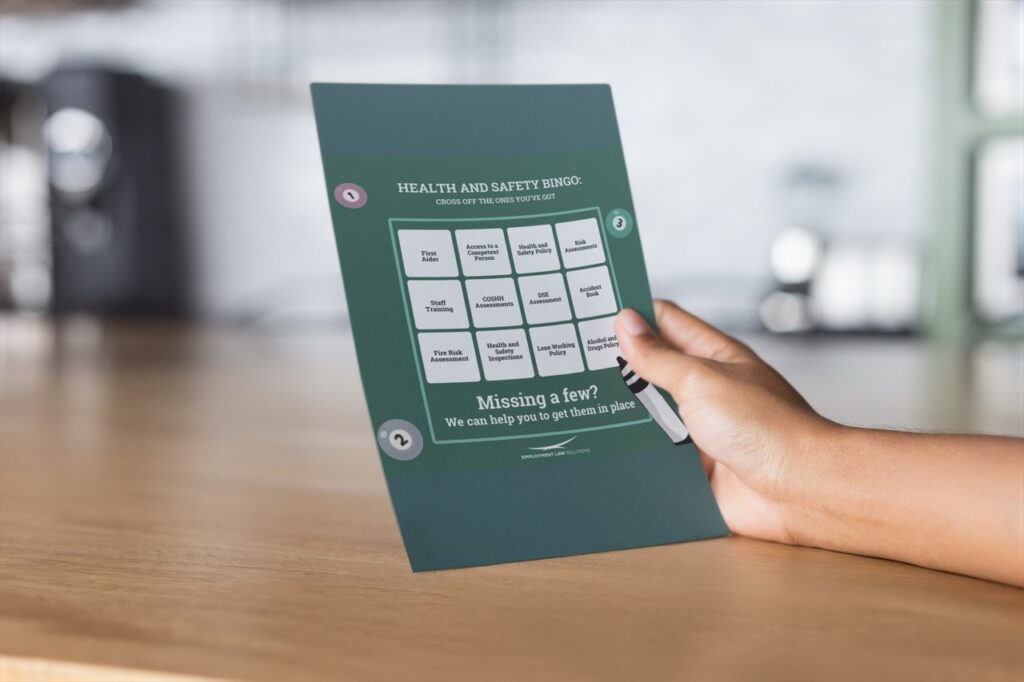

Health & Safety Bingo! Compliance Made Simple (and Not Boring!)

Health & Safety Bingo is here to prove that compliance doesn’t have to mean boring manuals, endless tick-boxes, or confusing jargon. If you’ve got five or more staff, there are a few essentials you need to cover, but it can be simple, visual, and even a little...

The Leng Review and risks to your business

Major Changes to Physician Associate Roles Following Leng Review: What NHS Practices Need to Know The recent publication of the Leng Review has included recommendations which require significant changes, specifically around the role of Physician Associates. What...

Do I need to do a fire risk assessment?

Fire risk assessments are a fundamental legal requirement in the United Kingdom that could, to be blunt, be the difference between life and death. Understanding your obligations under UK fire safety legislation is crucial for anyone responsible for premises,...